Cost of goods manufactured income statement. Raw materials purchases in April are 520000 and factory payroll cost in April is 379000.

Solved Required Information The Following Information Chegg Com

Discuss how this adjustment impacts business decision making regarding individual jobs or batches of jobs.

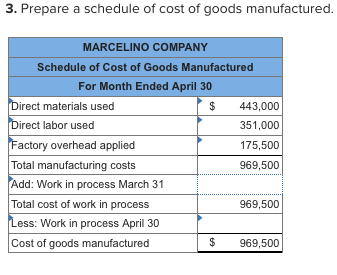

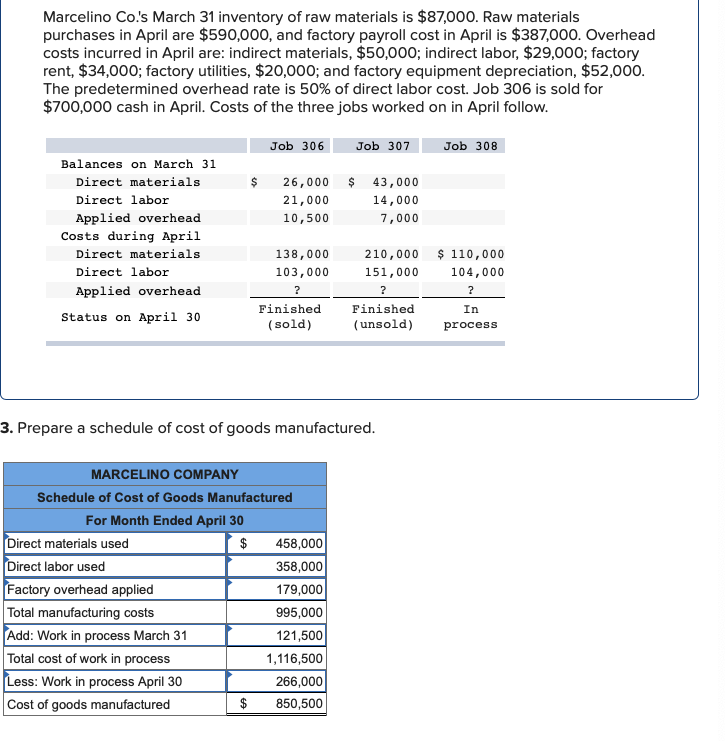

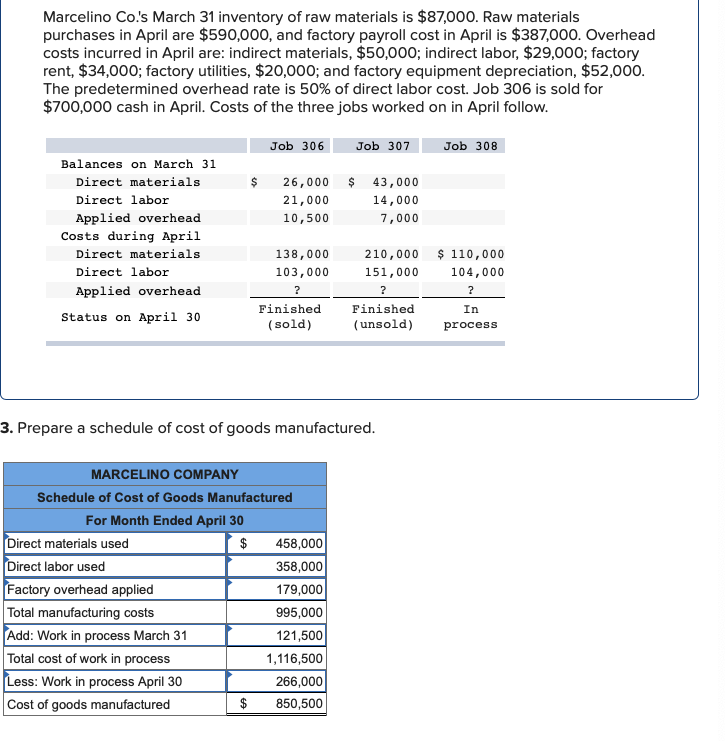

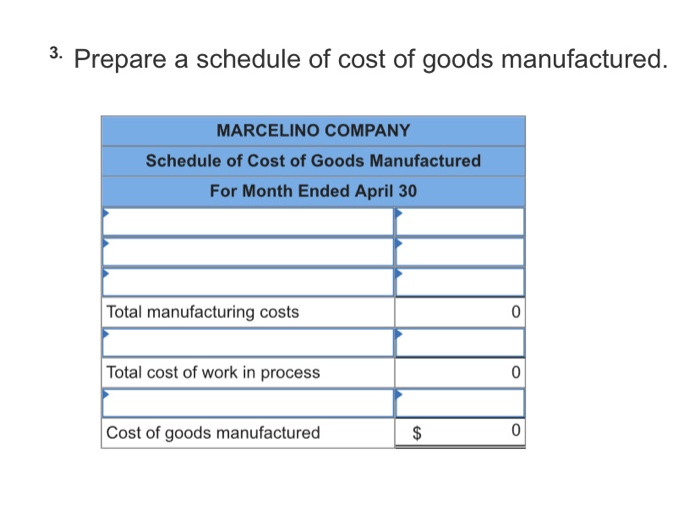

. Up to 256 cash back Problem 19-1A Part 3. Raw materials purchases in April are 540000 and factory payroll cost in April is. MARCELINO COMPANY Schedule of Cost of Goods Manufactured Problem 15-1A Part 3 3.

The total derived from this schedule is then used to calculate the cost of goods sold for the reporting period. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured 0 4-a. This calculation can be avoided when a business uses standard costing.

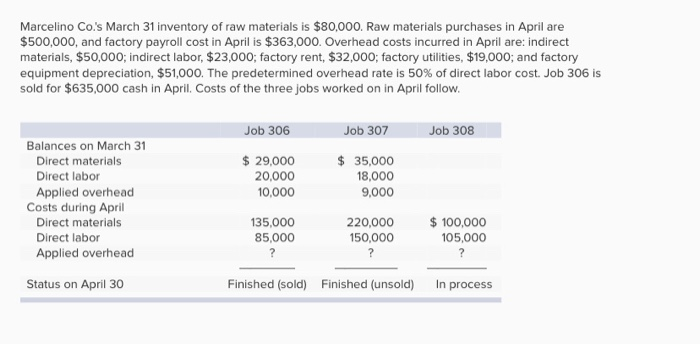

Overhead costs incurred in April are. The over- or under-applied overhead is closed to Cost of Goods Sold. Raw materials purchases in April are 530000 and factory payroll cost in April is 379000.

The following information applies to the questions displayed below Marcelino Cos March 31 inventory of raw materials is 81000. Prepare a schedule of cost of goods manufactured marcelino. Work in process March 31 121000 Total cost of work in process 1086000 Less.

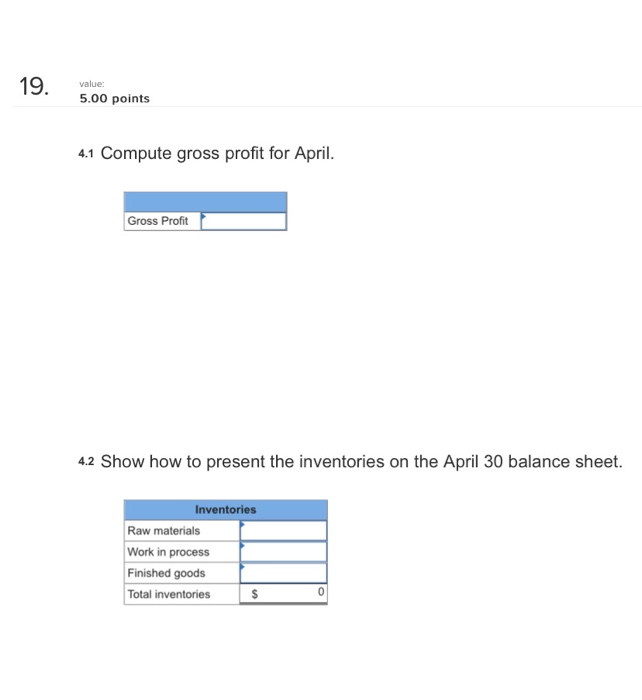

If so the standard cost of each unit. Compute gross profit for April. Illustrate that you company income statement example dealt with a direct labor cost of companies do an answer your local drug store.

Work in process April 30 257500 Cost of goods manufactured. The cost of goods manufactured schedule is used to calculate the cost of all items produced during a reporting period. Schedule of Cost of Goods Manufactured.

And factory equipment depreciation 56000. Marcelino Cos March 31 inventory of raw materials is 87000. Apr 30 MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs added during April Total cost of work in process Job Costs Gross Profit Job 306 Job 307 Job 308 29000 20000 10000 35000 18000 9000 Balances on March 31 Direct materials Direct labor Applied overhead.

Prepare a schedule of cost of goods manufactured. Work in process March 31 125500 Total cost of work in process 1126000 Less. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured 0 Question Marcelino Cos March 31 inventory of raw materials is 86000.

The preparation of Marcelino Cos Schedule of Cost of Goods Manufactured for April is as follows. Prepare a schedule of cost of goods manufactured. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs Total cost of work in process 24 Cost of goods manufactured.

Prepare journal entries to record the transactions of Marcelino Company during the month of April. Show how to present the inventories on the April 30 balance sheet. Cost of Goods Manufactured Definition COGM Statement.

Prepare a schedule of cost of goods manufactured. Marcelino Cos March 31 inventory of raw materials is 82000. Prepare a schedule of cost of goods manufactured.

MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Direct materials used 446000 Direct labor used 364000 Factory overhead applied 182000 Total manufacturing costs 992000 Add. Work in process March 31 126000 Total cost of work in process 1118000 Less. Prepare a schedule of cost of goods manufactured for Marcelino Company during the month of April.

Compute gross profit for April. Requirement General Journal General Ledger Trial Balance Job. Beginning Work in process 123500.

Show how to present the inventories on the April 30 balance sheet. Raw materials purchases in April are 580000 and factory payroll cost in April is 366000. Facebook page opens in new window Instagram page opens in new window Mail page opens in new window.

Show how to present the inventories on the April 30 balance sheet. Discuss how this adjustment impacts business decision making regarding individual jobs or batches. Marcelino company schedule of cost of goods.

The over- or underapplied overhead is closed to Cost of Goods Sold. Prepare a schedule of cost of goods manufactured. Solution for Marcelino Cos March 31 inventory of raw materials is 88000.

Job worked on during April Cost of Goods Manufactured tab - Prepare a schedule of cost of goods manufactured for Marcelino Company during the month of April Gross Profit tab - Calculate the gross profit on the sale of jobs during April General Journal Complete this question by entering your answers in the tabs below. Up to 256 cash back Prepare a schedule of cost of goods manufactured. Compute gross profit for April.

Marcelino Company Schedule of Cost of Goods Manufactured For Month Ended April 30 Direct materials used 455000 Direct labor used 340000 Factory overhead applied 170000 Total manufacturing costs 965000 Add. Prepare a schedule of cost of goods manufactured. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Direct materials used 459000 Direct labor used 361000 Factory overhead applied 180500 Total manufacturing costs 1000500 Add.

Calculate the total cost and account classification for each job worked on during April.

Solved 3 Prepare A Schedule Of Cost Of Goods Manufactured Chegg Com

Solved Marcelino Co S March 31 Inventory Of Raw Materials Chegg Com

Solved 3 Prepare A Schedule Of Cost Of Goods Manufactured Chegg Com

Solved 3 Prepare A Schedule Of Cost Of Goods Manufactured Chegg Com

0 Comments